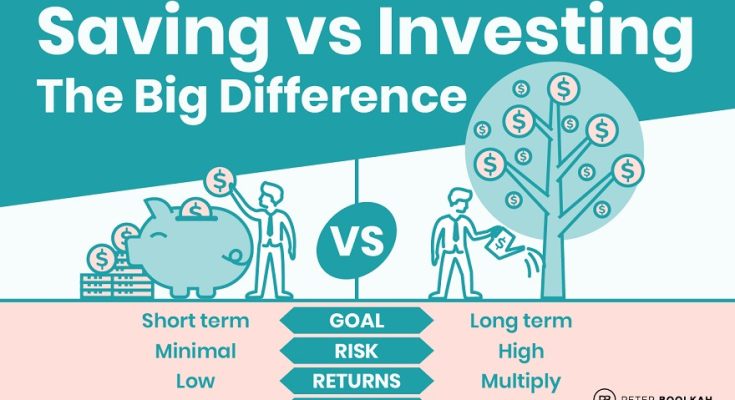

In the pursuit of financial stability and the realization of long-term aspirations, the terms “saving” and “investing” are often used interchangeably, yet they represent distinct and complementary strategies. While both involve setting aside money for future use, their purposes, risk profiles, and potential returns differ significantly. Understanding the fundamental distinctions between saving and investing is not merely an academic exercise; it is a critical piece of financial literacy that empowers individuals and businesses alike to make informed decisions, optimize their resources, and strategically build wealth in a dynamic economic landscape.

At its most basic, **saving** is the act of setting aside money for short-term goals or emergencies, typically in highly liquid and secure accounts. The primary objective of saving is capital preservation and easy access to funds. Think of your emergency fund, which might cover three to six months of living expenses, or money put aside for a down payment on a car, a short-term vacation, or a major appliance repair. These funds are usually held in savings accounts, money market accounts, or certificates of deposit (CDs), where the risk of losing your principal is extremely low, and the money can be accessed relatively quickly. In Thailand, this would typically involve depositing funds in a high-interest savings account at a commercial bank. The returns on savings are generally modest, often just enough to slightly outpace inflation, if at all. The emphasis is on safety and liquidity, providing a financial buffer and preparing for predictable, near-term expenditures. For a business, this mirrors holding cash reserves for operational expenses, short-term liabilities, or immediate capital needs.

**Investing**, on the other hand, is the act of allocating capital with the expectation of generating a return or appreciation over a longer period. The primary objective of investing is wealth creation, aiming for your money to grow significantly beyond its initial amount. This often involves a higher degree of risk compared to saving, as the value of investments can fluctuate. Investments typically include assets like stocks, bonds, mutual funds, real estate, or even starting a business. The timeline for investing is generally long-term, often five years or more, to allow for market fluctuations to average out and for the power of compounding to take full effect. For example, a Thai investor might put money into a diversified mutual fund that invests in global equities, or buy shares in a promising local company listed on the Stock Exchange of Thailand (SET), with the expectation of significant growth over a decade or more.

The critical difference lies in the relationship between **risk and return**. Saving offers low risk and, consequently, low returns. It’s about security and accessibility. Investing involves higher risk, but it also offers the potential for substantially higher returns. This potential for greater returns is your compensation for taking on that increased risk. For instance, while a savings account might yield 1-2% annually, a well-diversified stock portfolio could historically return 7-10% annually over the long term, albeit with periods of volatility. It is crucial to understand that past performance is not indicative of future results, and investing always carries the risk of loss.

Another key distinction is the **time horizon**. Saving is inherently short-term oriented. You save for goals that are typically within a few months to a couple of years away. Parking money earmarked for a down payment on a house next year in the stock market would be risky, as a sudden market downturn could jeopardize your ability to make that purchase. Investing, conversely, thrives on time. The longer your money is invested, the more powerful the effect of compound interest becomes, and the more time your portfolio has to recover from market dips. This extended time horizon allows investors to ride out short-term volatility and benefit from long-term market growth trends.

Consider the example of a young professional in Bangkok. They might *save* money in a separate account for an upcoming annual vacation to Chiang Mai, ensuring those funds are readily available and safe. Simultaneously, they might *invest* a portion of their income each month into a Retirement Mutual Fund (RMF) or a Super Savings Fund (SSF) through a local brokerage. The vacation fund prioritizes access and safety for a short-term goal, while the retirement fund embraces long-term growth and market fluctuations, leveraging compound interest for decades. Both are essential, but they serve different immediate purposes and carry different risk profiles.

For businesses, the distinction is equally pertinent. A company might *save* a portion of its cash flow in a high-yield business savings account to cover payroll and immediate operational expenses, ensuring liquidity. Concurrently, it might *invest* in research and development, expand into new markets, or acquire new machinery. These investments carry more risk but are aimed at generating significant future revenue growth and competitive advantage. Understanding which funds are for preservation and liquidity versus which are for growth and future opportunity is critical for sound corporate financial management.

In essence, saving is your financial foundation, providing security and liquidity for your near-term needs and emergencies. Investing is your wealth-building engine, designed to grow your money over the long haul to achieve significant future goals like retirement or substantial capital accumulation. A truly comprehensive financial strategy embraces both. It allocates money to secure, liquid savings for the short term while simultaneously directing funds towards diversified, growth-oriented investments for the long term, ensuring both present stability and future prosperity.