In the realm of financial planning, few elements evoke as much curiosity and occasional frustration as the insurance premium. We all pay them, often without a full understanding of the intricate algorithms and multifaceted considerations that determine their final figure. Far from being arbitrary, the calculation of an insurance premium is a sophisticated process, blending actuarial science, statistical analysis, economic forecasts, and a keen understanding of individual and collective risk. Demystifying this process is not merely an academic exercise; it empowers policyholders to make more informed decisions, potentially influencing their own costs and ensuring they receive optimal value for their coverage.

At its heart, an insurance premium is a reflection of the **likelihood of a claim occurring and the potential cost of that claim**. Insurers, in essence, are in the business of pooling risk. They collect premiums from a large number of policyholders to create a fund from which to pay out claims to the few who experience a covered loss. To ensure this fund remains solvent and profitable, the premium for each individual policy must accurately reflect the unique risk profile it represents. This involves a delicate balancing act of prediction and projection.

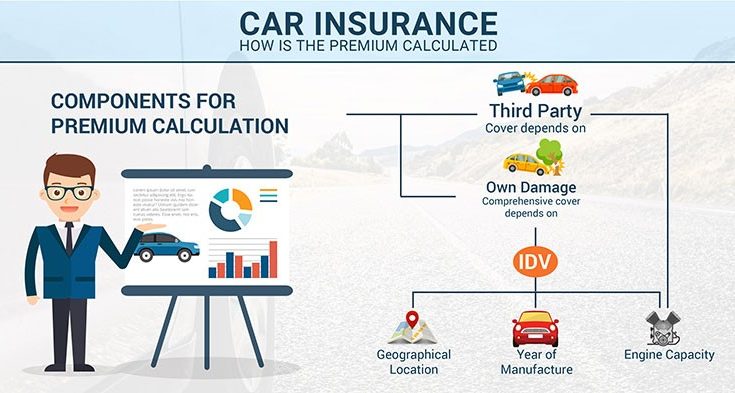

The foundational pillar of premium calculation is **risk assessment**. Insurers employ highly skilled actuaries and data scientists who analyze vast amounts of historical data to predict future events. For auto insurance, this means examining accident statistics, vehicle types, driver demographics, geographical accident rates, and even driving records. For home insurance, it involves assessing the property’s location (e.g., proximity to fire hydrants, flood zones, earthquake faults), construction materials, age of the home, and the local crime rate. Business insurance premiums factor in the industry, the nature of operations, revenue, employee count, claims history, and even specific safety protocols in place. Every factor that increases the probability or severity of a loss will generally lead to a higher premium.

Following risk assessment, the concept of **exposure** plays a crucial role. This refers to the potential financial magnitude of a claim. For property insurance, the exposure is largely the replacement cost of the asset – how much it would cost to rebuild a home or replace equipment. For liability insurance, exposure relates to the potential legal judgments, medical costs, and damage awards that could arise from a lawsuit. Higher exposure naturally leads to higher premiums, as the insurer faces a greater potential payout. This is why a brand new, expensive car will typically cost more to insure for comprehensive and collision coverage than an older, less valuable one, even if driven by the same person.

Beyond raw risk and exposure, **the policyholder’s specific choices** significantly influence the premium. The most direct example is the **deductible**. As a general rule, choosing a higher deductible means you’re agreeing to pay a larger portion of a covered loss out-of-pocket before the insurer contributes. This reduces the insurer’s financial exposure for smaller claims and often signals that you are less likely to file minor claims. Consequently, insurers reward this risk-sharing behavior with a lower premium. Conversely, a lower deductible will result in a higher premium.

Similarly, **coverage limits** directly impact the premium. Opting for higher liability limits on your auto or home policy, or a larger dwelling coverage amount for your home, will increase your premium because you’re asking the insurer to cover a greater potential financial loss. It’s a trade-off: higher protection generally comes at a higher price.

The **insurer’s operational costs and profit margins** also factor into the premium. This includes expenses related to claims processing, underwriting, sales and marketing, regulatory compliance, and general administration. Insurers are businesses, and like any other, they aim to generate a profit to remain solvent and invest in their services. These operational overheads are built into the premium charged to policyholders.

Furthermore, **competitive market conditions** play a subtle yet significant role. While insurers use sophisticated actuarial models, they don’t operate in a vacuum. They are constantly vying for customers in a competitive marketplace. If one insurer offers significantly lower rates for a comparable policy, others may be pressured to adjust their own pricing to remain competitive, even if their internal risk models suggest a higher premium. This market dynamic can sometimes work in the consumer’s favor, but it also means that premiums can fluctuate based on the broader industry environment, not just your individual risk.

Finally, **regulatory requirements and economic factors** can influence premiums. Government regulations often dictate certain minimum coverage levels, pricing methodologies, and consumer protection measures, all of which impact the insurer’s cost structure. Broader economic trends, such as inflation (which affects the cost of repairs and replacements), interest rates (which influence an insurer’s investment income), and even the frequency and severity of natural disasters (influenced by climate change), can lead to widespread premium adjustments across the industry.

In essence, an insurance premium is a meticulously calculated sum designed to cover potential claims, operational costs, and a reasonable profit, all while remaining competitive in the market. By understanding the interplay of risk assessment, exposure, policyholder choices, operational costs, market dynamics, and external factors, individuals and businesses can gain a clearer perspective on their insurance expenses. This knowledge empowers them to engage more effectively with their insurers, explore options like higher deductibles or appropriate coverage limits, and ultimately secure coverage that is both robust and financially sensible.