When shopping for health insurance, you’ll often come across various plan types with acronyms like HMO, PPO, and EPO. Understanding the differences between these plans is crucial to selecting the one that best fits your healthcare needs and budget.

In this article, we’ll break down the key features, advantages, and potential drawbacks of Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs) so you can make an informed choice.

What Is an HMO?

Health Maintenance Organization (HMO) plans emphasize coordinated care through a network of providers.

Key Features:

Primary Care Physician (PCP): You must choose a PCP who acts as your main healthcare provider and gatekeeper.

Referrals Required: To see a specialist, you need a referral from your PCP.

Network-Based Care: Care is generally covered only if provided by doctors, hospitals, and specialists within the HMO network.

Lower Premiums: HMOs typically have lower monthly premiums and lower out-of-pocket costs.

Advantages:

HMOs encourage preventive care and regular checkups by having a PCP oversee your health.

Costs are usually more predictable and lower due to the restricted network.

The coordinated approach can help avoid duplicate tests and streamline care.

Drawbacks:

Limited flexibility: If you want to see a specialist or provider outside the network, you may have to pay full cost unless it’s an emergency.

Getting referrals can add extra steps and wait times.

What Is a PPO?

Preferred Provider Organization (PPO) plans offer more flexibility with provider choice at a higher cost.

Key Features:

No PCP Required: You do not need to select a primary care physician.

No Referrals Needed: You can see any specialist without a referral.

In-Network and Out-of-Network Options: You get the best rates when using in-network providers, but you can also see out-of-network providers—though at a higher cost.

Higher Premiums: PPO plans usually have higher monthly premiums and higher out-of-pocket costs than HMOs.

Advantages:

Greater freedom to choose your doctors and specialists.

No need for referrals makes it easier and quicker to access specialty care.

Coverage for out-of-network care (with higher copays and coinsurance) adds flexibility.

Drawbacks:

Higher premiums and out-of-pocket expenses.

Costs can be less predictable since out-of-network care is more expensive.

Lack of coordinated care may lead to redundant tests or conflicting treatments.

What Is an EPO?

Exclusive Provider Organization (EPO) plans combine features of HMOs and PPOs but are less common.

Key Features:

No PCP Required: You can see any provider within the network without a referral.

No Out-of-Network Coverage: Except for emergencies, care outside the EPO network is generally not covered.

Moderate Premiums: EPO premiums often fall between HMOs and PPOs.

Network-Based Care: You must use network providers to receive coverage.

Advantages:

More freedom than HMOs since you don’t need referrals.

Generally lower premiums than PPOs.

You still benefit from negotiated rates with network providers.

Drawbacks:

No coverage for out-of-network care (unless it’s an emergency).

Network size can be smaller, limiting provider choices.

Less coordinated care compared to HMOs.

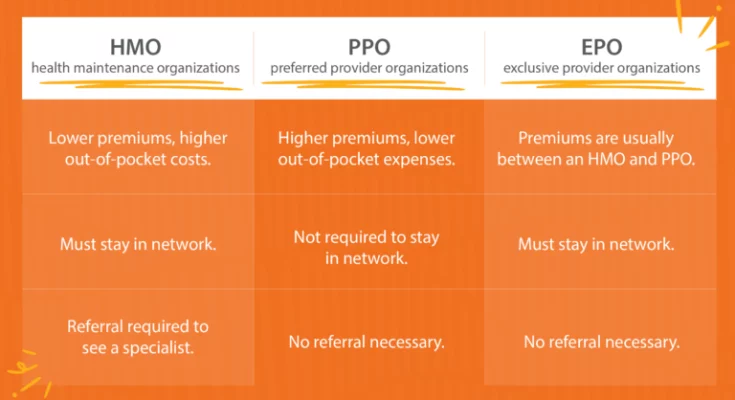

Comparing HMO, PPO, and EPO Plans Side by Side

Feature HMO PPO EPO

Primary Care Physician Required Not required Not required

Specialist Referrals Required Not required Not required

In-Network Coverage Yes Yes Yes

Out-of-Network Coverage Usually no (except emergencies) Yes (higher cost) No (except emergencies)

Premium Cost Lowest Highest Moderate

Flexibility Limited High Moderate

Coordination of Care High Low Moderate

How to Choose Between HMO, PPO, and EPO

Choosing the right plan depends on your individual healthcare needs, budget, and preferences. Consider these factors:

Cost Sensitivity: If you want lower premiums and are comfortable with a limited network and PCP referrals, an HMO may be ideal.

Flexibility Needs: If you want freedom to see any doctor or specialist without referrals and don’t mind higher costs, a PPO offers the most flexibility.

Balance of Cost and Flexibility: If you want some flexibility without the higher cost of a PPO and don’t mind staying within a network, an EPO could be a good middle ground.

Provider Preferences: Check if your preferred doctors and hospitals are in the plan’s network.

Health Needs: If you have chronic conditions requiring frequent specialist visits, a PPO’s no-referral structure might save time.

Final Thoughts

Understanding the differences between HMO, PPO, and EPO plans empowers you to select health insurance that aligns with your medical needs and financial situation. Each plan type has unique advantages and trade-offs:

HMOs offer lower costs and coordinated care but less flexibility.

PPOs provide the most freedom but at a higher price.

EPOs fall somewhere in between with moderate costs and moderate flexibility but require in-network care.

Review your options carefully during open enrollment periods and consult with insurance representatives or healthcare advisors if you need guidance. Making the right choice can improve your healthcare experience and protect your finances.